Halfway through the year, 2021 is proving to be The Year of the Associate. In Corporate alone, the AmLaw 100 hired 724 associates as of the end of May – an increase of 53 percent over the four-year average for the same period.

It’s truly a market-changing level of movement: More than 270 associates have left the 10 most profitable firms in New York. Meanwhile, Reuters reports this race for talent has prompted signing bonuses as high as $300,000 (and retention bonuses as high as $64,000).

Amid this race for talent, it’s imperative for law firm leaders to understand where they might (and might not) have leverage. While each firm’s specific needs may differ, taking some time to understand exactly who the market is fighting over now could prevent some buyer’s remorse later.

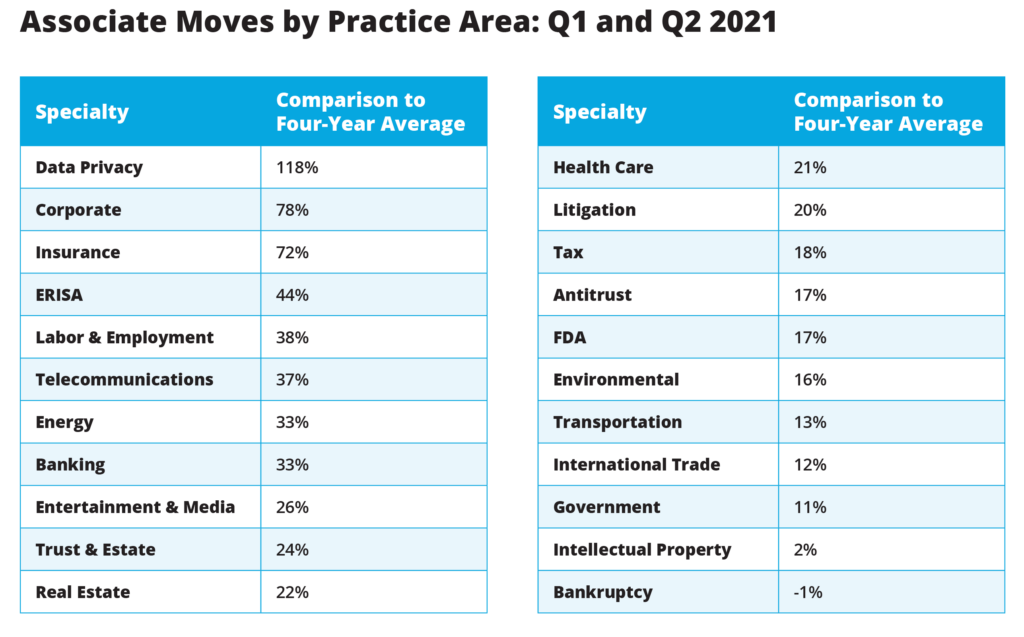

Decipher tracked lateral associate moves in the first half of 2021 and the same six month period for each of the prior four years. The data revealed insights to the practice areas, locations and experience level of top candidates being recruited.

Practice Areas

There were three practice areas where associate demand more than doubled in 2021: D; Entertainment & Media, up 156 percent; and Insurance, 111 percent.

- Data Privacy, up 118 percent over the four year average;

- Corporate, up 78 percent;

- Insurance, up 72 percent;

- ERISA, up 44 percent; and

- Labor & Employment, up 38 percent.

This is far from coincidental, given the nature of work sparked by the pandemic lockdowns. For example, as work went remote, the need for data privacy skyrocketed. A shaky job market has fueled work for ERISA and Employment lawyers; June’s unemployment rate of 5.9 percent remains well above the pre-COVID rate of 3.5 percent. And through June 21, 2021, there have been 1,952 lawsuits filed over COVID-19 insurance coverage, according to the University of Pennsylvania Carey Law School.

Demand for these specific areas may wane in the long-promised return to normalcy.

More significant in the long term is the high level of movement in the bedrock practice of Corporate. During Q1 and Q2, 1,822 corporate associates moved, 59 percent more than in 2019, which saw the second-most number of moves over the past four years.

Where is demand the lowest?

- International Trade, with lateral associate moves up “only” 21 percent over the four-year average;

- Government, 11 percent; and

- Intellectual Property, 2 percent.

Important note: The only practice area where movement actually slowed is Bankruptcy, with 1 percent fewer lateral associate jumps. The data suggests this work has leveled off after the more dire predictions for the post-COVID era.

Locations

When it’s easier to work anywhere, where are associates going?

The short answer: Southern California, which claimed three of the top five spots for the most active lateral associate hiring in the first half of 2021. San Diego, Los Angeles and Orange County saw increases over the four-year average of 88 percent, 65 percent and 62 percent, respectively.

The other top-five markets were New York (up 74 percent) and Miami (67 percent).

Interestingly, Northern California saw much slower rates of associate movement. Lateral associate moves were up 42 percent in San Francisco, while Silicon Valley’s rate of 23 percent made it the last-place finisher among markets tracked by Decipher. These are still double-digit rates of movement, and they are far from insignificant – but they demonstrate that while Big Tech goes remote, its lawyers may too.

Experience Level

The hottest recruits (and the biggest flight risks): Third- and fourth-year associates.

Though only tracked through Q1, in 2021 these associates have represented nearly one-third of all lateral associate moves. Proportionally, this marks a 14 percent increase over the four-year average for the same period. While movement remained somewhat flat with fifth-, sixth- and seventh-years, it dropped for first-years. Over the past four years, first-year associates represented about 7 percent of annual moves; so far in 2021, they account for only 1 percent.

This is a reflection of the training gap that could prove problematic for law firms moving forward: When COVID-19 forced a nationwide shutdown, the lawyers who were just months into their careers were suddenly remote workers, without access to the traditional training and mentoring they and their firms were counting on. Unless they were at firms that were uncharacteristically adept at virtual development, associates’ development stalled.

We could be facing a four-year swath of lawyers who cannot deliver the same product or pace as their predecessors; keep in mind the same thing happened to law students, too. This will be a major issue for the legal industry to address in the years moving forward, and it will take creativity, empathy and an innovative approach to associate development.